What It’s Like to Sell to Brickell Bay

We specialize in working with founders of legacy, profitable software companies who are ready for what’s next, whether that means stepping back, staying involved, or simply ensuring your business ends up in the right hands. We’ve walked in your shoes and know how to evaluate software businesses without slowing you down.

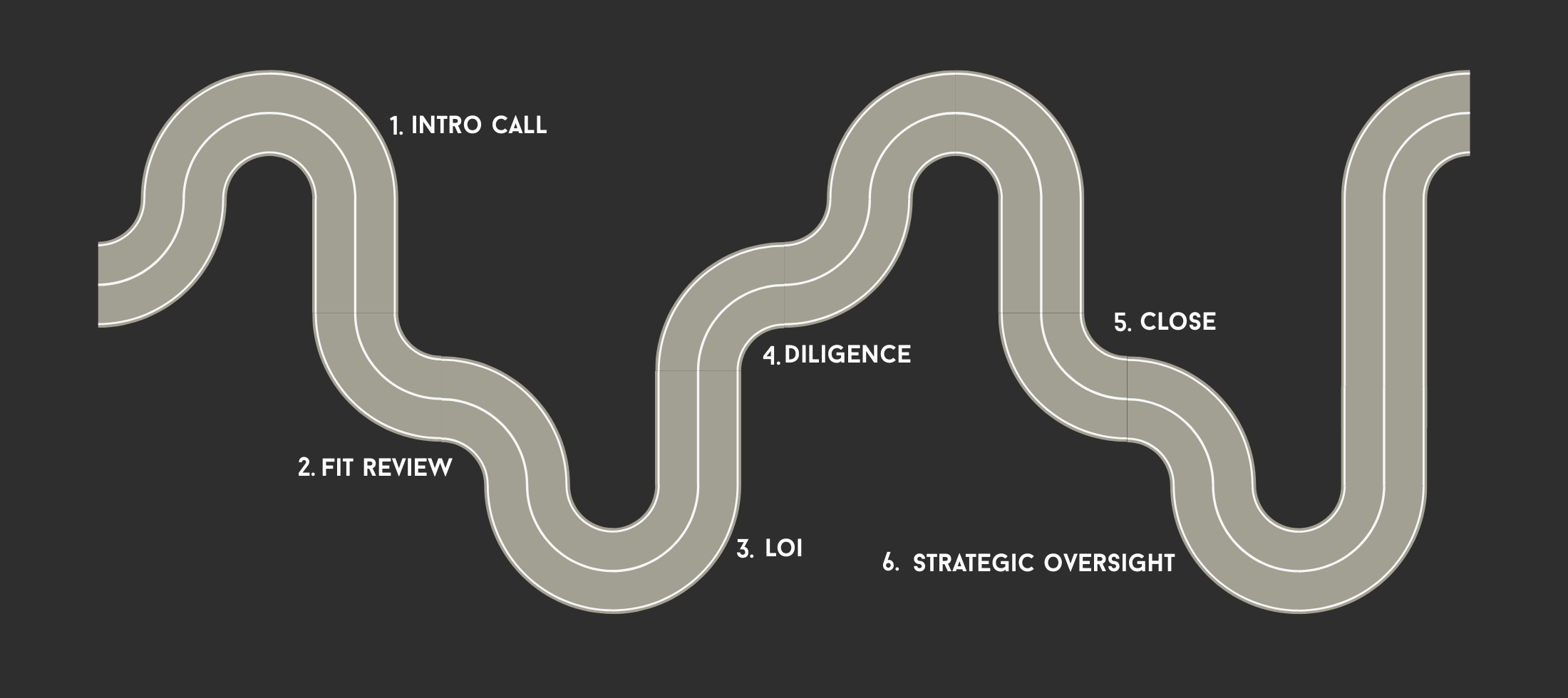

Here’s what our process looks like:

Step 1

Introductory Conversation

A no-pressure, confidential call where we learn about your business, your goals, and your timeline.

Note: Most founders we meet are first-time sellers. We’re happy to educate and never rush decisions.

Step 2

Initial Review

We take a focused look at your product, customer base, financials, and tech stack. No fluff, no unnecessary complexity, we know how to evaluate VMS companies quickly and respectfully.

Step 3

Letter of Intent

If there’s alignment, we send a clear, fair LOI. We don’t play games with valuation. What we offer is what we close at.

Step 4

Due Diligence (30–90 days)

A structured and efficient diligence process. You won’t get buried in requests. We’ve operated businesses ourselves and respect your time.

Step 5

Closing & Transition

Whether you're retiring or staying on, we’ll tailor a transition plan around you and your team. Many of our founders roll equity for a second bite at the apple.

Step 6

Strategic Oversight

We’re not a private equity firm looking to flip your company after 3-5 years. We own and operate for the long haul, with engineering, GTM, and operational support built in.

The Brickell Bay Sale Journey

6 Reasons Why Founders Choose Brickell Bay

1. Trusted by founders across manufacturing, govtech, ERP, CMMS, and beyond.

2. Founders can retain equity and stay in the game, or cash out entirely. We’re flexible.

3. Backed by a seasoned team with deep VMS experience.

4. Not backed by a fund clock we hold companies permanently.

5. Low-friction process with zero retrading.

6. Embedded engineering & GTM support post-close.

FAQs

What types of businesses does Brickell Bay invest in?

We acquire vertical software companies with $500K to $4M in recurring revenue. Our sweet spot is founder-led, profitable businesses serving niche markets with sticky customers.

What industries do you focus on?

We specialize in vertical SaaS especially legal, manufacturing, field services, and government software and we’re open to other fragmented markets with strong retention and low churn.

What’s your typical deal structure?

We’re flexible: we’ve done all-cash exits, earnouts, partial rollovers, and founder succession plans. Our goal is to align incentives, preserve legacy, and build long-term value.

How long does it take to close a deal?

We move quickly. From initial call to close, our process typically takes 30–60 days, depending on deal complexity and responsiveness.

What happens after the acquisition?

We don’t flip companies. We partner with founders or management teams to scale sustainably often helping build out sales, product, or finance functions, while protecting company culture.

Do founders need to stay on?

It’s entirely up to them. Some founders exit post-close, while others stay involved as advisors, minority shareholders, or long-term leaders. We tailor every deal to the founder’s goals.

Where is Brickell Bay based?

We’re based in Miami, FL but invest across the U.S. We travel frequently to meet founders in person.

Is Brickell Bay a fund or a family office?

We’re a permanent capital firm backed by long-term investors and entrepreneurial families. That means patient capital, no artificial exit timelines, and a true partnership mentality.

How do I start a conversation?

Just reach out, we respond quickly and confidentially. Even if now isn’t the right time, we’re happy to connect and stay in touch.